NEW JERSEY REAL ESTATE – Are You facing Facing Foreclosure? A General Perspective

New Jersey Real Estate-Nationwide foreclosure activity dropped in February to an 11-year low, according to new data from ATTOM Data Solutions, a fused property database.

This decrease marks the lowest point since November 2005, and the 17th consecutive month of annual decreases.

But despite this drop, 10 states still saw an increase in foreclosure activity. States that saw the largest increases include New Jersey with an increase of 16%, Delaware with 14%, Louisiana with 12%, Alabama with 10% and Hawaii with 8%.

Some cities also saw strong increases, contrary to the national trend. Houston, Texas, for example, increased 97% from an abnormally low February 2016. Other cities such as San Francisco and New York City also increased 25% and 9% respectively.

Additonally, despite dropping to an 11-year low, foreclosure starts saw an uptick of 7% in February from January, but were still down 13% from February last year. This marks the 20th consecutive month with year-over-year declines in foreclosure starts.

Some states countered the national trend with annual increases in foreclosure starts. The state that saw the highest increase was Alabama with an increase of 40% in foreclosure starts, followed by Texas at 26%, New Jersey at 24%, Florida at 12%, Illinois at 11% and Arizona at 9%.

Increasing foreclosure starts is becoming a trend. Foreclosure starts increased three of the last four months in Texas, two of the last three months in New Jersey, six of the last seven months in Illinois and six of the last 12 months in Arizona.

Real Estate Foreclosures- New Jersey Bucking the Trend

ATTOM explains there are two reasons why some states are seeing increases in foreclosure starts, contrary to the national trend.

“First is a backlog of legacy distress still lingering in states like New Jersey and Florida along with D.C. as a result a foreclosure process that became dysfunctional during the housing crisis in those states,” ATTOM Senior Vice President Daren Blomquist told HousingWire. “While the share of bubble-era originated loans that are actively in foreclosure is down to 52% nationwide, in DC those bubble-era loans still represent 71% of all foreclosures, while in New Jersey it’s 61% and in Florida it’s 56%.”

But not every state is still working through crisis-era loans. For those that aren’t, there is another phenomena causing an increase in their foreclosure starts.

“Secondly, states that have put the housing crisis and the bad loans originated during the crisis firmly in the rear-view mirror, foreclosure rates bottomed out last year and are gradually beginning to rise, corresponding to gradually relaxed lending standards,” Blomquist said. “This is why we’re seeing consistent increases in foreclosure starts in states like Arizona, where only 39% of foreclosures are tied to bubble-era loans, and in Texas, where only 33% of foreclosures are tied to bubble-era loans.”

“The good news in these states is that even with the rise in foreclosure starts, foreclosure activity still remains below pre-recession levels,” he said.

NEW JERSEY REAL ESTATE Should I Buy or Rent?

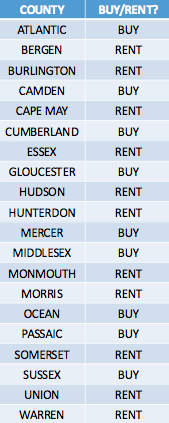

To make that decision a bit easier, real estate database ATTOM Data Solutions has released a report that breaks down the math in New Jersey’s housing markets and determines whether it’s more affordable to rent a three-bedroom home or buy one in each of them.

The report analyzed nearly all of New Jersey’s counties — all but Salem — using 2017 fair market rent data from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics and 2016 public record sales deed data.

Based on monthly payments alone, ATTOM found it’s more affordable to rent than buy in 55 percent of New Jersey’s markets, or 11 counties: Bergen, Essex, Hudson, Monmouth, Union, Morris, Burlington, Somerset, Hunterdon, Warren and Cape May.

Monthly rent in Union County was calculated at about $1,700, for example, compared to a mortgage payment of more than $2,300, including property taxes and interest.

In the other nine counties, mortgage payments were found to be cheaper than monthly rent. In Cumberland County, owning a home was calculated at just $870 per month, compared to $1,570 monthly to rent.

END

New Jersey Real Estate In Perspective is a blog by Dwayne Randolph.

If you like this article, please like or share.

Click here to stay up to date with our new articles on the New Jersey Real Estate market and company news and promotions.

Dwayne Randolph is the Founder of CREIV Properties, LLC, a real estate solutions company. If you have a property you need to sell fast. We buy houses in NJ and nationwide.