In addition to having the biggest mean bill at $8,549 in 2016, the New Jersey Real Estate taxes the highest effective tax rate at 2.31 percent, according to an ATTOM Data Solutions study published by RealtyTrac.com.

“ The effective tax rate is average annual property tax expressed as a percentage of the average estimated market value of homes. “

New Jersey real estate taxes over 10K

Of the nine counties in the country where the average bill exceeded $10,000, four are in New Jersey: Essex County real estate, Union County real estate, Morris County real estate and Bergen County real estate. The study counted the 586 counties with a population of at least 100,000.

Essex County property owners were saddled with the highest taxes, at an average of $11,550, followed by Bergen County at $11,311 and Union County at $10,821. Cumberland County taxpayers paid the least, $4,027, according to state data from the Department of Community Affairs.

New Jersey real estate taxes highest by effective rate

The average residential bill in the state has risen from $8,161 in 2014 to $8,353 in 2015 to $8,549 in 2016.

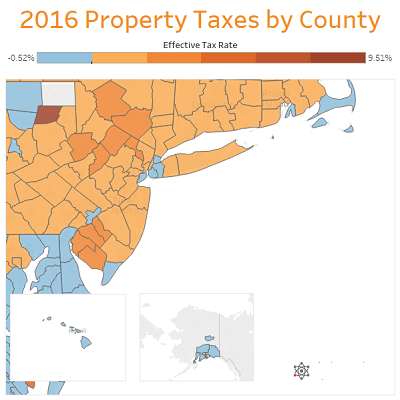

After New Jersey real estate taxes, Illinois and Texas have the second- and third-highest effective tax rates at 2.13 percent and 2.06 percent, respectively. Pennsylvania (1.89) and New York (1.88) rank seventh and eighth nationally.

Hawaii (0.32 percent), Alabama (0.48 percent) and Colorado (0.52 percent) have the lowest effective property tax rates.

New Jersey is dense and has higher than average labor costs

This is not a joke. Only Rhode Island packs more people per square mile, Pfeiffer said. It costs more to provide services to a larger group of people than a small or sparsely populated town.

“New Jersey real estate taxes has a high cost-of-living state,” Pfeiffer said. “In order to attract people, (employers) have to pay well.” In this case, the employers are the local governments who are saddled with the “legacy costs” associated with unionized public employees.

END

New Jersey Real Estate In Perspective is a blog by Dwayne Randolph.

If you like this article, please like or share.

Click here to stay up to date with our new articles on the New Jersey Real Estate market and company news and promotions.

Dwayne Randolph is the Founder of CREIV Properties, LLC, a real estate solutions company. If you have a property you need to sell fast. We pay cash for houses in NJ and nationwide